Highlights

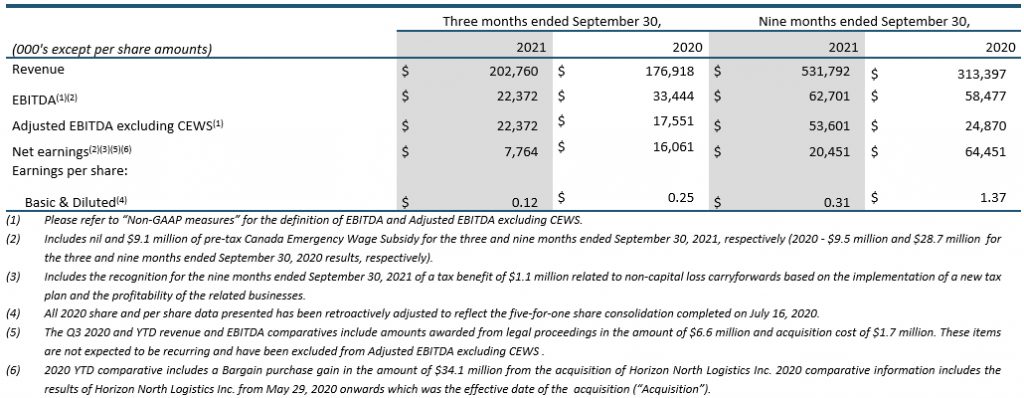

- The Corporation generated consolidated revenue of $202.8 million for Q3 2021 which increased 17% compared to Q2 2021;

- EBITDA for Q3 2021 was $22.4 million, and after adjusting for wage subsidies included in Q2 2021 of $4.1 million, was higher by $4.1 million, or 22%, when compared to Q2 2021;

- Net earnings were $7.8 million and basic earnings per share of $0.12 for Q3 2021 compared to net earnings of $8.2 million in Q2 2021 and basic earnings per share of $0.13. Excluding the wage subsidies recorded in Q2 2021, net earnings increased by $3.7 million in Q3 2021 reflecting higher business volumes primarily in WAFES;

- The Corporation extended its credit facility agreement effective on September 7, 2021 for a three-year term. The amendment increases the available limit from $175 million to $200 million and provides an uncommitted accordion of $125 million. The Company has significant unused credit facilities to execute on its growth strategy with debt at $79.6 million at September 30, 2021;

- Dexterra Group was selected as the winner of the Avetta Award for Canada’s Safest Employer in the Services Sector presented by Canadian Occupational Safety Magazine and Key Media; and

- Dexterra Group declared a dividend for the fourth quarter of 2021 of $0.0875 per share for shareholders of record at December 30, 2021 to be paid January 17, 2022.

Toronto, Ontario, Canada, November 9, 2021 – TSX Symbol: DXT

Third Quarter Financial Summary

Third Quarter Operations Analysis

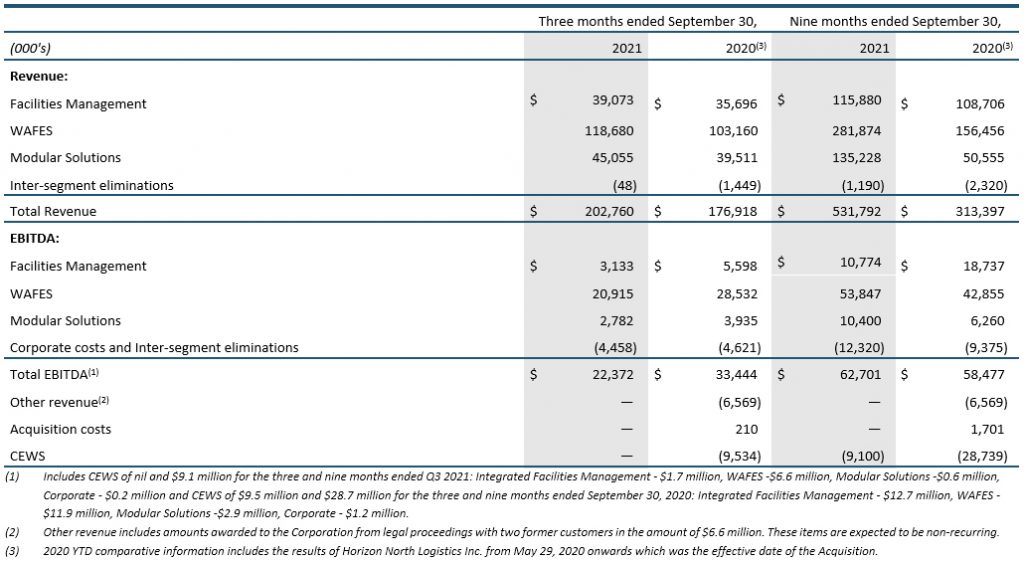

Integrated Facilities Management

For Q3 2021, Integrated Facilities Management revenues were $39.1 million and increased by $3.4 million, or 9%, from the $35.7 million in Q3 2020. The increase is mainly attributable to the reduction of certain COVID-19 health measures and new business. Management expects this upward trend to continue as government COVID-19 restrictions are lifted, especially in the aviation and retail sectors, which continue to face challenges. Aviation volumes were approximately 50% of pre-COVID-19 levels in Q3 2021.

Adjusted EBITDA excluding CEWS as a percentage of revenue is 8.0% for Q3 2021, which is slightly below 8.6% in Q2 2021, and an improvement from 6.0% recorded in Q3 2020. The increased margin from Q3 2020 is due to management’s focus on margin improvements and better resource utilization compared to 2020 costs of operating in a more restrictive COVID-19 environment.

Year to date, Integrated Facilities Management revenues were $115.9 million and increased by $7.2 million or 7% from the $108.7 million in 2020. The growth in the segment is mainly attributable to the reduction of certain COVID-19 health measures and new contracts. Certain key industry sectors continue to have reduced volumes such as aviation and retail. Management expects the growth rate to improve as pandemic restrictions are lifted in Q4 2021. Management also expects increased bidding activity in the future periods as customers finalize their post-COVID plans.

Year-to-date Adjusted EBITDA excluding CEWS as a percentage of revenue for this segment is 8% which is consistent with Q2 2021 and improved from 6% in the same period in 2020.

Workforce Accommodations, Forestry and Energy Services (“WAFES”)

WAFES is comprised of two revenue streams: Workforce accommodations (“WA”) & Forestry and Energy Services. A significant portion of our WAFES business is support services which are not capital intensive and aligns closely with our integrated facilities management business. The remainder relates to owned services.

Revenue from the WAFES segment for the three months ended September 30, 2021 was $118.7 million, an increase of $15.5 million compared to Q3 2020. WAFES revenue performance was strong in Q3 2021 due to stronger camp occupancy, mobilization of new contracts with a significant oil-sands customer, and Q3 being the peak season for the Forestry business. Forestry, including Fire Camps, contributed $19.5 million of revenue in Q3 2021, compared to $12.7 million in Q3 2020. Pipeline camps in British Columbia rebounded strongly in September with good utilization, though our Kitimat open camp will likely continue to be closed until late Q2 2022 due to delays in scheduling of the LNG Canada project. The increase in all areas of the business included a $6.2 million increase in Energy Services revenue related to the robust activity in the energy sector in the quarter. The comparative revenue for Q3 2020 also had revenues of $8.7 million from the Kitimat open camp, which is temporarily closed in late 2021, as well as legal settlements of $6.6 million, which did not reoccur in 2021.

The Q3 2021 Adjusted EBITDA excluding CEWS as a percentage of revenue is 18%, which is slightly higher than the Q3 2020 comparative of 17%.

Revenue from the WAFES segment for the nine months ended September 30, 2021 was $281.9 million, an increase of $125.4 million compared to Q3 2020. The increase in segment revenues was primarily driven by the Acquisition, which added $70.3 million to revenue reported year to date in 2021. Adjusting for the Acquisition, revenue represents an increase of $55.3 million over the prior period, which is attributable to growth throughout the business.

Excluding the impact of CEWS and legal settlements, the Adjusted EBITDA excluding CEWS as a percentage of revenue was 16% in 2020 and it improved to 17% for the nine-month period ended September 2021. This increase in margin resulted from stronger support services revenue with the addition of new contracts and business.

Modular Solutions

Modular Solutions segment revenues for Q3 2021 were $45.1 million, a decrease of $3.2 million from Q2 2021. The decrease was caused by site and administrative delays in the rapid affordable housing projects with the City of Toronto, site access delays on projects in British Columbia and the resolution of a historical contract dispute. Revenue from these projects is expected to be recorded in Q4 2021 and Q1 2022. In comparison to Q3 2020, revenue for Q3 2021 increased by $5.5 million, or 13.7%.

EBITDA for Q3 2021 was $2.8 million, a decrease of $1.9 million from Q2 2021. Adjusted EBITDA excluding CEWS as a percentage of revenue was 6% for the quarter compared to Q2 2021 of 9%. The timing of projects impacted the optimization of plant capacity and related overhead absorption. EBITDA margins are expected to rebound to normal levels in 2022 of approximately 7%.

Revenue from the Modular segment for the nine months ended September 30, 2021 was $135.2 million, an increase of $84.7 million, which is attributed to the timing of the Acquisition in 2020. Year-to-date EBITDA was $10.4 million, which is $4.1 million higher than the same period in 2020 due to the timing of the Acquisition. The Adjusted EBITDA excluding CEWS is higher by $6.5 million. Adjusted EBITDA excluding CEWS as a percentage of revenue for the year-to-date Q3 2021 is consistent at 7% as compared to the prior year.

A key metric for the Modular Solutions segment is the backlog of projects and timing of backlog execution. The focus for this business unit is to secure and increase backlog, which was $92.6 million for rapid affordable housing at the end of Q3 2021, excluding $34.8 million of contracts being finalized with existing customers and $25.3 million for Industrial and U.S. manufacturing supply projects signed in Q3 2021. Additionally, Modular Solutions has recurring modular business beyond the projects above worth approximately $40 million per annum, which mainly consists of education modules, retail stores and kiosks. A key goal over time is also to diversify our modular product market verticals. The overall outlook remains positive with significant opportunities to increase revenue and EBITDA in the near term as our backlog grows.

Liquidity and Capital Resources

For the three months ended September 30, 2021, cash generated by operating activities was $1.8 million, compared to $21.2 million in the same period of 2020 and compared to $20.2 million in Q2 2021. The decrease from Q2 2021 was driven primarily by the increase in working capital required to support the increase in revenue and the seasonality of the business in the forestry and education sectors. Cash flows from operating activities in Q3 2020 were also positively impacted by $6.6 million in legal settlements and CEWS of $9.5 million.

The Corporation’s financial position and liquidity are strong. The Corporation generated Free Cash Flow of $24.6 million for the nine months ended September 30, 2021. Debt is lower by $5.6 million year to date and will further decrease in Q4 2021 and into 2022, absent M&A activities.

Additional Information

A copy of Dexterra Group’s Condensed Consolidated Interim Financial Statements for the three and nine months ended September 30, 2021 and 2020 and related Management’s Discussion and Analysis (“MD&A”) have been filed with the Canadian securities regulatory authorities and are available on SEDAR at sedar.com and Dexterra Group’s website at dexterra.com. The Consolidated Financial Statements have been prepared in accordance with International Financial Reporting Standards and the reporting currency is in Canadian dollars.

Conference Call

Dexterra Group will host a conference call and webcast to begin promptly at 8:30 Eastern time on November 10, 2021 to discuss Dexterra Group’s third quarter results.

To access the conference call by telephone the conference call dial in number is 1-800-319-4610.

A live webcast of the conference call will be accessible on Dexterra Group’s website at dexterra.com/investor-presentations-events/ by selecting the webcast link. A PowerPoint presentation will be posted on Dexterra Group’s website at dexterra.com on November 9, 2021 to be reviewed on the conference call. An archived recording of the conference call will be available approximately one hour after the completion of the call until December 9, 2021 by dialing 1-855-669-9658, passcode 7809.

About Dexterra Group

Dexterra Group employs more than 6,000 people, delivering a range of support services for the creation, management, and operation of infrastructure across Canada.

Powered by people, Dexterra Group brings best-in-class regional expertise to every challenge and delivers innovative solutions, giving clients confidence in their day-to-day operations. Activities include a comprehensive range of facilities management services, industry leading workforce accommodation solutions, innovative modular building capabilities, and other support services for diverse clients in the public and private sectors.

For further information contact:

Drew Knight, CFO

Head office: Airway Centre, 5915 Airport Rd., 4th Floor Mississauga, Ontario L4V 1T1

Telephone: (416) 767-1148

You can also visit our website at dexterra.com

Non-GAAP measures

Certain measures in this news release do not have any standardized meaning as prescribed by generally accepted accounting principles (“GAAP”) and, therefore, are considered non-GAAP measures. Non-GAAP measures include “EBITDA”, calculated as earnings before interest, taxes, depreciation, amortization, depreciation from equity investments, share based compensation, bargain purchase gain (reduction), and gain/loss on disposal of property, plant and equipment. “Adjusted EBITDA excluding CEWS as a percentage of revenue”, calculated as EBITDA before acquisition costs and non-recurring items (“Adjusted EBITDA”) and excluding Canada Emergency Wage Subsidy (“CEWS”) (“Adjusted EBITDA excluding CEWS”) divided by revenue, and “Free Cash Flow”, calculated as net cash flows from (used in) operating activities, less sustaining capital expenditures, payments for lease liabilities and finance costs, to provide investors with supplemental measures of Dexterra Group’s operating performance and thus highlight trends in its core businesses that may not otherwise be apparent when relying solely on GAAP financial measures. Dexterra Group also believes that securities analysts, investors and other interested parties frequently use non-GAAP measures in the evaluation of issuers. Dexterra Group’s management also uses non-GAAP measures in order to facilitate operating performance comparisons from period to period, to prepare annual operating budgets, and to determine components of management compensation.

These measures are regularly reviewed by the Chief Operating Decision Makers and provide investors with an alternative method for assessing the Corporation’s operating results in a manner that is focused on the performance of the Corporation’s ongoing operations and to provide a more consistent basis for comparison between periods. These measures should not be construed as alternatives to net earnings and total comprehensive income determined in accordance with GAAP as indicators of the Corporation’s performance. The method of calculating these measures may differ from other entities and accordingly, may not be comparable to measures used by other entities. For a reconciliation of these non-GAAP measures to their nearest measure under GAAP please refer to “Reconciliation of non-GAAP measures” of the Corporation’s MD&A.

Forward-Looking Information

Certain statements contained in this news release may constitute forward-looking information under applicable securities law. Forward-looking information may relate to Dexterra Group’s future outlook and anticipated events, business, operations, financial performance, financial condition or results and, in some cases, can be identified by terminology such as “continue”; “forecast”; “may”; “will”; “project”; “could”; “should”; “expect”; “plan”; “anticipate”; “believe”; “outlook”; “target”; “intend”; “estimate”; “predict”; “might”; “potential”; “continue”; “foresee”; “ensure” or other similar expressions concerning matters that are not historical facts. In particular, statements regarding Dexterra Group’s future operating results and economic performance, its leverage, NRB Modular Solutions production capacity and backlog, and its objectives and strategies are forward-looking statements. These statements are based on certain factors and assumptions, including expected growth, results of operations, performance and business prospects and opportunities regarding Dexterra Group, which Dexterra Group believes are reasonable as of the current date. While management considers these assumptions to be reasonable based on information currently available to Dexterra Group, they may prove to be incorrect. Forward-looking information is also subject to certain known and unknown risks, uncertainties and other factors that could cause Dexterra Group’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward- looking information, including, but not limited to: the ability to retain clients, renew existing contracts and obtain new business; an outbreak of contagious disease that could disrupt its business; the highly competitive nature of the industries in which Dexterra Group operates; reliance on suppliers and subcontractors; cost inflation; volatility of industry conditions could impact demand for its services; a reduction in the availability of credit could reduce demand for Dexterra Group’s products and services; Dexterra Group’s significant shareholder may substantially influence its direction and operations and its interests may not align with other shareholders; its significant shareholder’s 49% ownership interest may impact the liquidity of the common shares; cash flow may not be sufficient to fund its ongoing activities at all times; loss of key personnel; the failure to receive or renew permits or security clearances; significant legal proceedings or regulatory proceedings/changes; environmental damage and liability is an operating risk in the industries in which Dexterra Group operates; climate changes could increase Dexterra Group’s operating costs and reduce demand for its services; liabilities for failure to comply with public procurement laws and regulations; any deterioration in safety performance could result in a decline in the demand for its products and services; failure to realize anticipated benefits of acquisitions and dispositions; inability to develop and maintain relationships with Indigenous communities; the seasonality of Dexterra Group’s business; inability to restore or replace critical capacity in a timely manner; reputational, competitive and financial risk related to cyber-attacks and breaches; failure to effectively identify and manage disruptive technology; economic downturns can reduce demand for Dexterra Group’s services; its insurance program may not fully cover losses. Additional risks and uncertainties are described in Note 22 of the Corporation’s Consolidated Financial Statements for the years ended December 31, 2020 and 2019 contained in its most recent Annual Report filed with securities regulatory authorities in Canada and available on SEDAR at sedar.com. The reader should not place undue importance on forward-looking information and should not rely upon this information as of any other date. Dexterra Group is under no obligation and does not undertake to update or alter this information at any time, except as may be required by applicable securities law.